The past year has seen construction insurance costs rise across the board, driven by material and skill scarcity, as well as global inflation and even international conflicts.

For builders and construction firms, this requires additional budgets and a closer look at the risks and dangers associated with construction projects and their mitigation. Construction is a risky industry, with only 36.4% of construction companies surviving the first five years of operations and 72% of firms admitting that projects take longer than anticipated, resulting in up to 20% budget overruns due to reworks and repairs.

To insure your construction project (and protect yourself against various liabilities and financial losses), it’s vital to understand the most common insurance practices and critical types of insurance instruments and policies offered in the portfolio, for your ongoing or upcoming projects.

What is Construction Insurance?

Construction insurance refers broadly to industry-specific policies that are beneficial and sometimes legally required to begin a construction project.

These policies protect stakeholders (such as contractors, property owners, subcontractors, developers, homeowners, and lenders) from potential financial losses, lawsuits, and other costly risks.

It’s regulated and insured differently depending on the region or state, and no construction project is identical to another. The policies and coverage you may need for one project might not be suitable for another – even if it’s in the same location.

A single construction insurance policy is insufficient for most projects, so it’s worth noting that the term ‘construction insurance’ varies depending on the type and nature of the project or property.

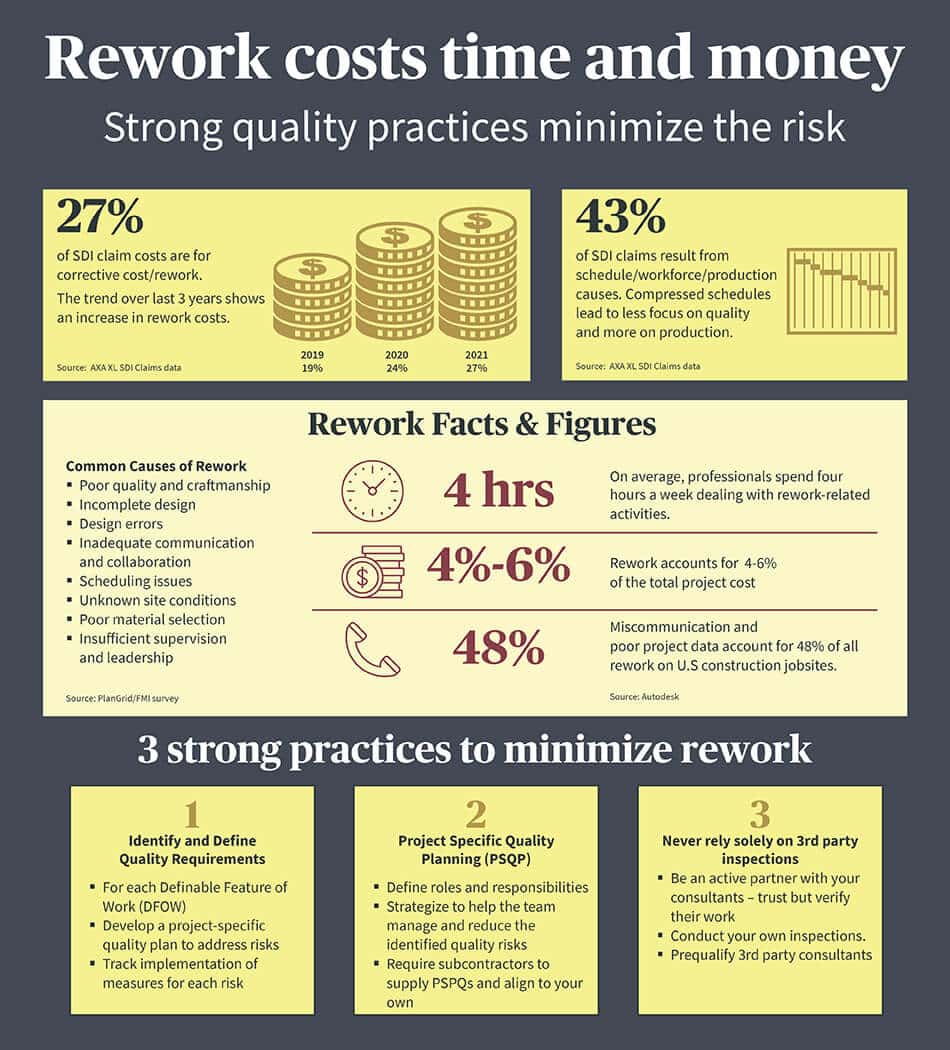

Source: AXA XL – Critical Construction Risk Topics: Rework Costs Time and Money

What Risks Does Construction Insurance Cover?

Construction is one of the riskiest industries in the world. As such, every project must abide by a set of safety standards, with insurance coverage being of great assistance when things don’t go according to plan.

Typically, construction insurance coverage includes the following at a minimum:

- Property damage to the construction site, including materials, structures, and equipment, resulted from water damage, fire, accidents, natural disasters, theft, or vandalism.

- The equipment and tools used on the construction site are insured against damage, theft, or loss.

- Installation processes of systems or equipment at the site are insured against damage or resulting issues.

- In the event of a worker injury, construction insurance should cover medical expenses, rehabilitation, and lost wages.

- Third-party damage or injury (such as to neighboring properties or pedestrians) due to construction operations is insured against the associated legal costs.

Did you know that nowadays, water damage is recognized as the second most frequent cause of loss during construction? Because of this rising risk, some insurers are now recommending and even requiring developers and construction companies to implement water leak detection systems like WINT before providing builders’ risk insurance.

What are the Benefits of Having Construction Insurance?

Insuring your construction project is one of the first and most important steps to reducing overall business risk and ensuring compliance with regulatory requirements and contractual obligations.

Construction insurance offers multiple benefits to your business at every stage of the project:

Risk Coverage

Construction insurance offers coverage for the various risks entailed in the project. Risk coverage can provide companies with peace of mind and protection against financial losses and legal liabilities.

In cases that unforeseen circumstances lead to a court case against you, your construction insurance can provide coverage for legal expenses (like attorney fees, witness fees, and other court expenses) as well as costs and damages you may need to pay if instructed so by the court or through a settlement agreement. These may include, depending on your policy; injury claims, damage claims, and product claims.

Risk Mitigation

A key role of construction insurance is risk mitigation. Insurance companies set the premiums and deductibles according to the perception of established construction risk management processes in the organization. Insurers’ demands can include proof of safety measures implemented, best practices applied, and adequate employee safety training.

With water intrusion damage accounting for 70% of all construction litigation, water risk is one of the most critical risks your insurers will expect you to mitigate. One way to significantly reduce water risk in construction is by harnessing innovation and AI-powered leak detection and resolution. So it’s no wonder that leading insurers like HSB now offer leak insurance warranty to reduce the financial impact of water damage deductibles on construction projects.

Continuity

Completing on time and within budget can be a challenging task. With construction insurance coverage demands, you could be more inclined to invest in resources to avoid delays and disruptions.

6 Types of Construction Insurance You Need to Be Aware Of

Construction insurance aims to provide maximum coverage against potential risks and liabilities without incurring extensive insurance fees. To get the most coverage, you will need several construction insurance policies to form an insurance envelope for your project and the risks it naturally entails.

While every project is unique and requires different areas and types of coverage, some construction insurance policies are relevant to most, if not all, construction endeavors. Let’s take a look at the most common and critical ones.

1. Builder’s Risk (Course of Construction) Insurance

Builder’s Risk Insurance, also known as Construction Insurance (COC), is a type of property insurance policy that covers damage or losses that occur during the project.

Traditionally purchased by the property owner, the developer, or the general contractor on the project, builder’s risk insurance provides first-party coverage against damage, theft, and vandalism.

The builder’s risk insurance policy’s coverage ends upon the completion of the construction project.

Usually, builder’s risk policies offer coverage for:

- Buildings and structures

- Materials used in the project

- Building foundations

- Machinery and on-site equipment

- Temporary structures (like scaffolding and safety railings)

- Paving, fencing, and outdoor fixtures

- Lawns, trees, and other plantlife added by the builder

Standard basic builder’s risk insurance will only cover damages caused by weather, fire, and third-party (non-employee) vandalism or theft. You can extend the policy’s coverage limits by including what insurers call ‘premium coverage’ to protect against events like earthquakes, acts of war, or terrorism.

Water intrusion accounts today for more than 30% of the loss ratio in Builder’s Risk policies. This makes Builder’s Risk Insurance one of the most critical insurance policies to have, as it covers water damage during construction. With WINT, you can even mitigate water intrusion risk at the source before it happens as well as reduce water waste by as much as 25%.

2. General Liability Insurance

General Liability Insurance, or Commercial and Contractor General Liability (CGL) Insurance, is an all-risk insurance coverage option.

The CGL provides you with liability protection for claims relating to bodily injury, personal injury, property damage, and other liabilities that can arise during construction operations. Contractors and builders are legally or contractually required to have some kind of minimum level of general liability insurance to be given permits to operate.

CGL insurance policies aim to address the costs of third-party damage claims, such as damage to a third party’s vehicle or building or injury to a non-worker on the site. They may also include advertising claims involving defamation and faulty workmanship results.

Traditionally covered under basic general liability insurance are:

- Job-related injuries

- Faulty workmanship

- Advertising injury or defamation

3. Professional Liability Insurance

Professional Liability Insurance is a type of insurance policy that extends the scope of General Liability Insurance to cover certain causes for legal action. It should also protect individuals from financial liability against claims that advance from innocent mistakes or failures to deliver professional services as agreed in the contract.

Required for operation in numerous states, E&O insurance policies cover legal fees, lawsuit settlements, and reparation costs from disappointed clients in the following types of cases:

- Operational mistakes and oversights in providing the services

- Undelivered services

- Failure to meet deadlines

- Accusations of negligence

4. Inland Marine Insurance

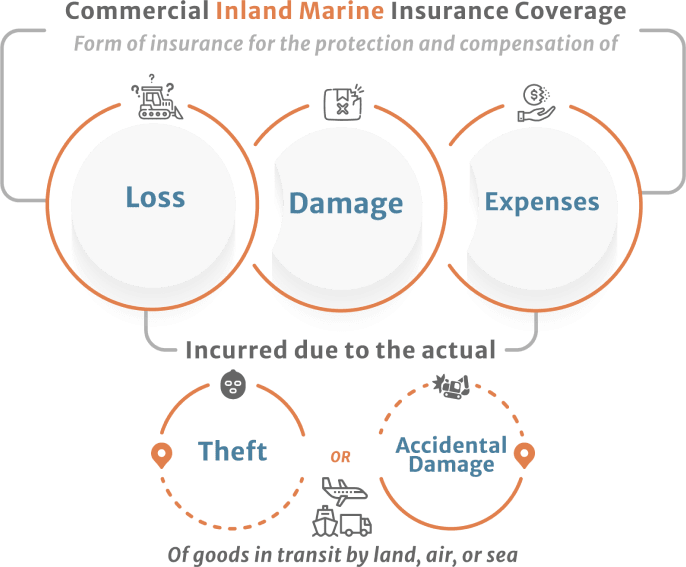

Source: FARMERBROWN – Inland Marine Insurance

With its misleading name coming from an era where most things were transported by water, Inland Marine Insurance (also known as a floater policy, equipment floater insurance, tool, and equipment insurance, or contractor equipment insurance) is a broad type of coverage that pertains to the movable assets and property used in your construction project, whether owned or leased.

Inland Marine Insurance policies traditionally cover items, materials, products, and equipment transported over land or temporarily stored at the work site, warehouse, or third-party storage facility. It can serve as an extension of your general liability policy and is especially critical when renting expensive equipment for construction operations.

Today, Inland Marine Insurance coverage has evolved to cover many types of property risk. These include mobile equipment, property in the custody of a subcontractor or storage facility, property used in different locations, computer equipment, and sensitive digital information.

While there’s plenty of room for flexibility and customization, an Inland Marine Insurance policy should include coverage for risks pertaining to:

- Equipment (including tools such as drills, excavators, forklifts, cranes, and computer hardware) theft from a job site

- Equipment damaged in transport to or from a job site

- Equipment damaged in a flood, fire, or natural disaster at a job site

5. Commercial Auto Insurance

Commercial Auto Insurance, also called Commercial Vehicle Insurance, covers a wide range of owned and rented vehicles, including cars, trucks, vans, trailers, and more.

Any registered work vehicles are legally required to have a Commercial Auto Insurance policy, with certain levels of coverage for bodily injury and property damage liability.

Commercial Insurance protects the vehicles used for business but does not typically cover heavy equipment like tractors, forklifts, or the cargo inside.

While your Commercial Auto Insurance policy will be uniquely tailored for your business, the standard coverage options include:

- Liability coverage protects the business and its employees from expenses associated with accidents the employees may have caused.

- Physical harm coverage insures damages to company vehicles after they suffer a collision. You can expand this coverage to include protection in cases of theft, vandalism, or natural disasters.

- Medical fee coverage that helps pay for injury-related expenses that an incident may incur. These include various medical bills, hospital fees, ambulance costs, and, in the most unfortunate of cases, funeral expenses.

- Uninsured motorist coverage includes damages and injuries that uninsured third-party drivers caused. This is vital in cases where a company vehicle is involved in an accident against an uninsured driver who cannot cover the high costs your business may suffer.

6. Workers’ Compensation Insurance

Workers’ Compensation Insurance is not unique to the construction industry and is mandatory for business operations in most countries and states.

This insurance covers the expenses typically entitled to employees who are injured or fall ill as a result of their work on the job site. These benefits may include:

- Medical expenses

- Missed wages and loss of income

- Ongoing recovery costs related to an injury (such as physical therapy)

- Legal fees and legal defense in case of a lawsuit

- Funeral costs and death benefits to deceased workers’ families

Leverage technology innovation to mitigate risks in your construction projects

The costs of construction insurance for projects and businesses depend highly on the level of compliance with insurer requirements and the degree to which you can lower their risk in insuring your project.

One way to drastically reduce the risk of water damage and leaks and ensure continuity and on-time delivery of your construction project is to employ advanced technological solutions in leak detection and mitigation in construction, deployed by WINT systems.

Our IoT-based and AI-powered water management technology can help reduce premiums and deductibles on your construction insurance and prevent the costly results of water damage to properties, and most importantly – the financial viability of your construction project.