Being good to the world around you is good for you and for your business. The same is true for corporations navigating the treacherous waters of today’s global economy and looking to maximize their contribution to the world while minimizing their negative impact on the environment and their communities.

The aspects in which this impact is measured are ‘Environmental, Social, and the Governance’ of sustainability efforts – abbreviated as ESG.

Being good also pays back in business growth. Between 2018 and 2022, the sales growth of products with ESG-related claims outpaced products without them from 6.4% to 4.7%. ESG policies also play a vital role in securing investments, with nearly 75% of global asset managers saying they incorporate ESG considerations across their investment platforms.

What are ESGs?

ESG standards and regulations are guidelines and laws businesses, investors, and other stakeholders use to evaluate how adequately a company addresses environmental, societal, and governance factors in its operations and investments.

Compliance with ESG standards is implemented through organizational policies and communicated to shareholders, stakeholders and relevant authorities through ESG reports.

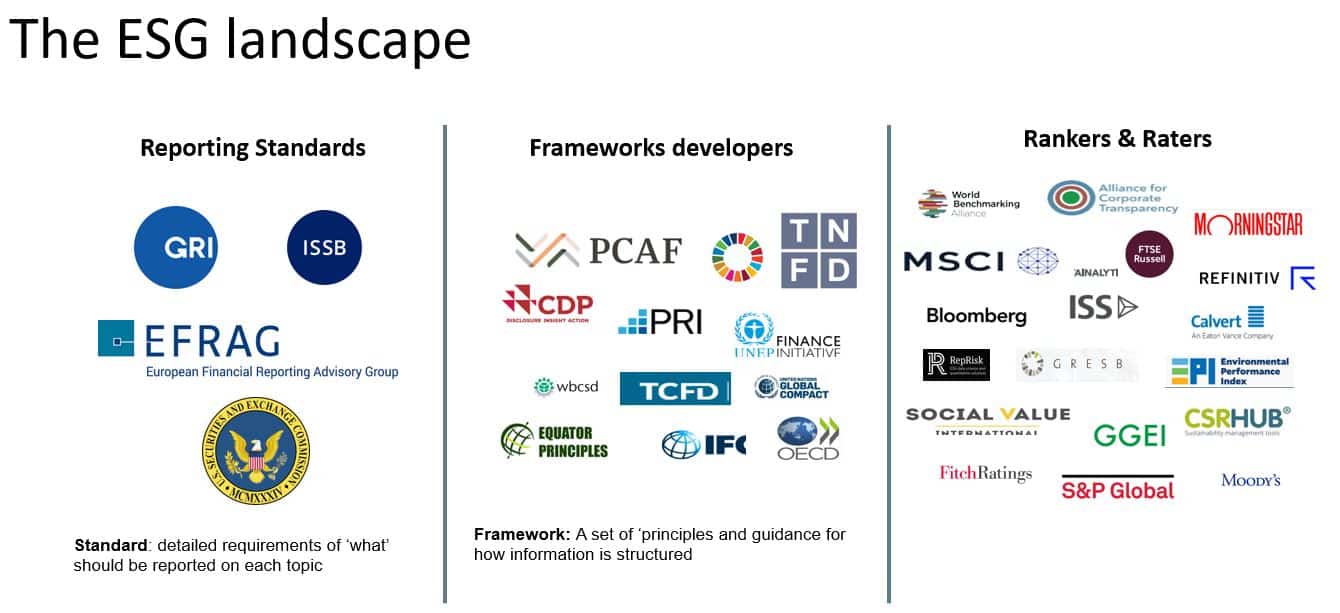

There is currently no single global ESG standard framework, and different legislators take slightly different approaches to ESG compliance, with the main variations being mostly in how ESG compliance is reported and what region-specific standards are prioritized.

In addition, several independent ESG reporting frameworks can help businesses develop their ESG strategy and policies. These include:

- The Global Reporting Initiative

- The Sustainability Accounting Standards Board (SASB)

- The United Nations Sustainable Development Goals (SDGs)

Regardless of the ESG framework you choose or the regional regulations you must comply with, the foundational pillars are the same across frameworks and standards and include Environmental, Social, and Governance aspects.

As time passes and the impact of pressing issues like climate change worsens, the pressure on companies to improve ESG practices may increase.

What are the three pillars of ESG?

Environmental – The ecological impact an organization has on the planet. This includes the operational use or production of pollutants and dangerous chemicals, as well as the overall carbon footprint, energy efficiency, water conservation, and other environmental sustainability efforts within the business and its supply chains.

Social – The symbiotic relationship an organization has with its employees, partners, investors, customers, suppliers, and other stakeholders. Included under the social aspect of ESG is your approach to inclusion and diversity, human rights, fair working laws and compensation, ethical practices, and the organization’s impact on the communities within which it operates.

Governance – The organization’s approach to sustainability policies and practices, monitoring, documenting, and transparency in reporting on the compliance and ESG strategies employed. Governance also includes transparency around supply chain risk mitigation, corporate training, and ongoing activities to execute the strategies outlined.

Benefits of Implementing an ESG Strategy

Regulatory compliance – Sometimes, implementing an ESG strategy is not a choice but a requirement to operate in certain markets or be eligible for specific financial services (from banks, investors, and insurers). With a well-planned ESG strategy, you can take a proactive approach to changing ESG regulations to stay a step ahead of lawmakers.

ESG risk management – Environmental and social disruption is coming, and businesses unprepared for its implications are neglecting a vital component of their risk management strategy – ESG-related risks. A comprehensive ESG policy can help future-proof your organization’s financial vitality, operations, and reputation. This way, you can identify ESG risks, make informed decisions and allocate the resources necessary to mitigate those risks.

Demonstrating commitment to stakeholders – Investors, business partners, clients, and employees today factor ESG in their decision-making processes. Implementing and showcasing ESG standards is vital to retaining and boosting capital flow, retaining and attracting talent, as well as building stronger partnerships with other organizations committed to ESG principles.

Competitive edge – Customers and clients are, perhaps, the most important stakeholders in today’s rapidly changing market. Through transparent communication of your ESG policies and efforts, you can gain a competitive edge and improve customer retention. The results are clear – 79% of businesses where the importance of ESG principles had increased between 2019 and 2023 reported that customer retention had improved. In addition, 71% of C-Suite and functional leaders anticipate the growing significance of ESG in corporate performance.

Cost savings – ESG policies and initiatives can help reduce expenses and even create new cash flows for organizations. For companies that need to comply with local ESG regulations to operate, failing to demonstrate compliance can result in costly fines and loss of business. Optimizing energy efficiency, eliminating water waste, and finding better management solutions are only a few of the benefits of voluntary adoption of ESG standards. Water waste alone can cause a significant strain on finances itself. On that matter, WINT’s advanced AI and machine learning technologies can monitor water flows and alert staff as soon as anomalies are detected. WINT systems are deployed worldwide in large enterprises like Microsoft, HP, Google and Intel as part of their ESG strategy. In iconic structures such as the Empire State Building for example, WINT led to a water consumption reduction of 7.5 million gallons per year. This amounts to a saving of over $100,000 a year, while preventing water damage and reducing tons of carbon emissions in the process.

7 Essentials all ESG Policies must have

The first step to making ESG a reality is to implement ESG policies via documents that detail the specific actions, approaches, and processes the organization is committed to in an effort to meet ESG standards or regulations.

ESG policies are unique to every business, so relying on a template may complicate the task of creating a comprehensive ESG policy for your organization. That said, there are several components and steps you can’t skip when crafting your ESG policy.

1. Identify and engage relevant stakeholders

Stakeholders in the preparation and execution of an ESG strategy can be investors, employees, major clients, or representatives of communities that are affected by your organization’s actions or have an influence on them.

To craft an ESG policy that fully reflects your commitment to bolstering transparency, accountability, and sustainability, you must engage these stakeholders to understand their ESG concerns and goals.

In addition, leadership commitment to an ESG strategy is critical for successfully integrating ESG principles in the organization, as is the clear and comprehensive division of duties and responsibilities.

2. Set clear KPIs and goals

With the C-suite aboard and the stakeholders engaged, you can begin setting goals, objectives, and measurable KPIs to form your ESG policy. It’s important to set the policy’s strategic course, prioritize relevant areas, and ensure the policy reflects the organization’s culture, values, and commitment to action.

It is equally important to set KPIs for measuring progress toward your objectives. The KPIs relevant to your organization are not necessarily important to others, so be sure to prioritize the ones that mean the most to your business.

3. Prepare for change

The only thing in life that’s permanent is change. As we’ve all discovered during the COVID-19 pandemic, a global crisis can put the operational continuity of any business at risk at any time. Stakeholders are, therefore, more aware of the need for systematic preparation measures and a more proactive approach to crisis management.

In crafting your ESG policy, include a crisis response strategy that will enhance stakeholder confidence in your ability to continue operations in times of crisis or emergency.

4. Train your employees

For an ESG policy to become a reality, it’s important that employees are aware and engaged with the ESG program. A comprehensive and effective ESG policy goes beyond ensuring that everyone is informed regarding the ESG policy.

Instead, it requires role-specific training and a cohesive approach to collaboration, shared responsibility, and a commitment to sustainability as part of your business practices.

5. Outline the policy execution strategy

Implementing an ESG strategy involves turning the theoretical goals and objectives into targets on a roadmap and allocating the resources necessary for each ESG initiative. Your action plans should drill deeper into the “how” of your corporate ESG strategy, including operational, financial, and administrative involvement that solidifies ESG activities, and list the specific commitments, efforts, and timelines for each action plan in the ESG policy.

6. Monitor and enforce compliance

No matter how comprehensive and well-written your ESG policy is, it’s worthless if it’s not actively applied. Applying them entails monitoring and regular assessments of ESG policy execution.

Monitoring and reporting helps you stay compliant with regulatory requirements and ensures your execution strategy is realized as expected. Through reporting and compliance enforcement, you are likely to discover new areas for improvement and strong assets hidden in plain sight.

7. Review and adjust your policies

ESG policies are living documents that change and develop to ensure they remain relevant and effective over time. Through regular reviews of your ESG policies, you can make informed revisions to the policy, introduce new best practices, and address current trends, as well as integrate stakeholder input.

Embrace ESG with Innovation

One of the best ways to promote ESG principles in an organization is through the adoption of innovative solutions and technologies that approaches sustainability and promotes best governance practices.

Harnessing the power of machine learning and AI to help reduce environmental impact and comply with regulatory ESG frameworks is a quick win for any ESG initiative or policy.

WINT offers enterprises and organizations of all scales a unique AI-powered water sustainability solution that dramatically conserves water consumption, while detecting and mitigating water leaks and damage in your properties or facilities.

WINT is an Enterprise-Grade solution for leak mitigation, water conservation and carbon footprint reduction for commercial, residential, and industrial applications. WINT innovation will impact your business towards realizing a cost-effective ESG policy.